| unit name | quantity |

|---|---|

| unit name | quantity |

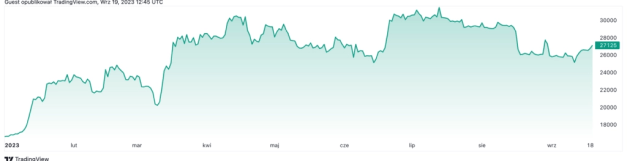

Bitcoin BTC exchange rate

Since yesterday -

+2 165.11 USD 3.26%

Last week -

-262.38 USD -0.38%

Last month -

-579.86 USD -0.84%

The chart shows the current Bitcoin quotes in the BTC/PLN° currency pair. On the Kanga exchange you can buy this cryptocurrency listed to stablecoin.

VOLUME (24H)

4 018 093 538 USD

CAPITALIZATION

137 186 560 803 USD

PRICE ATH*

126 173.18 USD -45.62%

DATE ATH*

06.10.2025

*All Time High — historically the highest value.

The record indicates the price of cryptocurrency quoted in US dollars. Presenting the price in this manner does not confirm the availability of this pairing on the Kanga cryptocurrency exchange. On Kanga, you will find quotations for cryptocurrencies against USDT, a stablecoin pegged to the US dollar’s value.

How much does Bitcoin cost?

What is the current price of BTC? To discover the current price of Bitcoin, check the BTC to PLN exchange rate.

The Bitcoin chart displayed on our site shows the real-time price in the BTC/PLN currency pair, allowing you to see today’s rate in PLN. Additionally, next to the exchange rate, there’s a feature displaying the 24-hour value change.

For more information on BTC, continue reading.

What is Bitcoin?

Bitcoin is the world’s first and most well-known cryptocurrency. It is a pioneering digital currency that incorporates traditional monetary characteristics known for centuries. It serves as an increasingly accepted payment method for goods and services. Since BTC is based on blockchain technology, no central authority controls it, leading to its characterization as a decentralized currency.

A brief history of Bitcoin: who created BTC?

Bitcoin was conceived by Satoshi Nakamoto, a pseudonym for the individual or group responsible for developing the original Bitcoin network protocol. The true identity of Satoshi Nakamoto remains a mystery, with numerous speculations and theories over the years.

Nakamoto is hailed as a pioneer of blockchain technology, which laid the groundwork for many subsequent cryptocurrency projects. Although there were pre-existing concepts for a “virtual currency,” Bitcoin was the first to implement a peer-to-peer (P2P) system.

Who owns the most Bitcoin? It is believed that Nakamoto holds the largest amount of BTC, with over one million bitcoins in his wallet, positioning him among the wealthiest individuals globally.

What is bitcoin halving?

Bitcoin halving is an event that reduces the reward for mining new bitcoins by half. Miners, the individuals responsible for generating new bitcoins, achieve this by solving complex mathematical puzzles to create a new block of transactions.

Initially, the reward for mining a single block of Bitcoin was 50 BTC. However, approximately every 210 000 blocks — or roughly every four years—this reward is halved. The purpose of Bitcoin halving is to control the supply of the cryptocurrency and prevent inflation. Since the number of new coins entering circulation from mining remains constant and the reward per block is halved every 210 000 blocks, the rate at which new coins are introduced to the system gradually decreases over time.

How is the price of bitcoin calculated?

The price of Bitcoin, like other cryptocurrencies, is determined in the free market, based on supply and demand. Not being under the control of any central government or financial institution means its value is always in flux, with the market dictating its worth.

On a daily basis, the price of BTC varies on cryptocurrency exchanges, determined by the transactions between buyers and sellers. Similar to other financial markets, its price is influenced by market conditions, investment trends, the level of investor interest, and external factors.

Various tools are available for tracking cryptocurrency prices, including websites, mobile apps, and professional trading platforms that facilitate cryptocurrency trading.

Why do bitcoin price changes affect other cryptocurrencies?

Bitcoin, being the largest and most well-known cryptocurrency, often serves as the primary reference point for the value of other cryptocurrencies. The price movements of Bitcoin can significantly impact the value of alternative cryptocurrencies (altcoins).

This correlation is due to the interconnectedness of the cryptocurrency market. When investors in various cryptocurrencies notice a decline in BTC’s price, fear can lead them to sell off their holdings in other tokens as well. This reaction can cause a widespread decrease in the value of altcoins.

Conversely, when the price of Bitcoin rises, and its value increases, it often incites a sense of optimism among investors. As a result, they may invest in other cryptocurrencies, driving up demand and, consequently, their prices.

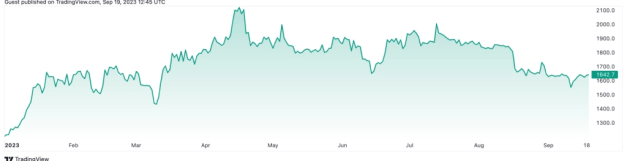

Remember, the volatility of cryptocurrency prices is natural and occurs frequently. Below, we compare the price charts of Bitcoin and Ethereum. At first glance, both charts appear nearly identical.

Why is Bitcoin so expensive?

The price of Bitcoin is influenced by several factors, including:

- Limited supply – bitcoin is a decentralized digital currency with a cap of 21 million units, meaning no additional BTC can be created. As demand increases, so does its price, making BTC resistant to inflation unlike fiat currencies issued by central banks.

- Growing Interest – in recent years, Bitcoin has surged in popularity among investors seeking alternative investment opportunities.

- Commercial acceptance – BTC’s acceptance as a payment method by numerous companies, including industry giants like Microsoft and PayPal, enhances its demand and value. Notably, El Salvador has recognized Bitcoin as legal tender, further validating its real-world use.

- Speculation – often viewed as a speculative asset, investors purchase Bitcoin hoping for rapid profits, influenced by market analysis.

- Mining complexity – the process of mining new bitcoins, or ‘mining,’ becomes increasingly difficult and resource-intensive over time, contributing to the cryptocurrency’s rising value.

In summary, Bitcoin’s high price can be attributed to its limited supply, growing interest, broader commercial acceptance, speculative nature, and the escalating costs of mining.

Is investing in Bitcoin safe?

Bitcoin is considered a safe cryptocurrency investment. Like any currency, it has its pros and cons, and its safety largely depends on how it is stored and utilized. What is the safest way to store Bitcoin?

Technically, blockchain—the technology underpinning Bitcoin—is highly secure, leveraging cryptography and transaction verification by a network of users. This means each transaction must be confirmed by multiple network nodes, rendering it nearly impossible to falsify or alter.

While Bitcoin in Poland is not regulated by financial institutions, this leads to a potential lack of user protection against fraud or irregularities. All transactions on the blockchain are irreversible, meaning errors such as sending bitcoins to an incorrect address cannot be rectified.

Security risks, however, may emerge if an investor incorrectly executes a transaction or becomes a fraud victim. Storing Bitcoin in online wallets poses risks, including theft by hackers. Thus, opting for an offline hardware wallet, like Ledger, is advisable.

To mitigate risks, it’s essential to:

- select highly-rated exchanges,

- utilize secure wallets, and

- adopt robust security practices, including strong passwords, two-factor authentication (2FA), and regular software updates.

In essence, bitcoin can be considered relatively safe, provided it is securely stored and transactions are conducted with reputable parties. Caution against suspicious offers and activities is also crucial.

The history of bitcoin’s price

The price history of Bitcoin is marked by significant volatility, characteristic of cryptocurrency markets, which are inherently more unstable than traditional financial markets.

Launched in 2009, Bitcoin saw the emergence of its first buying and selling platforms by 2010. In its early years, its price hovered around a few dollars. By 2013, however, its value surged, exceeding $1,000.

Consider if you had delved into the cryptocurrency realm in 2011, purchasing an entire Bitcoin for less than $5. Initially, Bitcoin’s price was not particularly high, and due to minor price fluctuations, you overlooked your acquisition. Over the years, Bitcoin’s price experienced rises and falls. It wasn’t until a decade later, upon reading about Bitcoin’s all-time high (ATH) in November 2021, that you remembered your Bitcoin. That very day, you sold your cryptocurrency, earning over $68,000.

In 2021, Bitcoin reached its all-time high (ATH), soaring to more than $68,000—equivalent to nearly 300,000 Polish złoty—on exchanges. This marked the highest price point in Bitcoin’s history to date.

Do you have to buy a whole bitcoin?

Contrary to what some might think, investing in Bitcoin doesn’t require purchasing a whole BTC at once. Cryptocurrencies are divisible into smaller units, facilitating transactions and everyday use.

This means you can own Bitcoin worth just a few dollars or even pennies, enabling transactions without the need for investing tens of thousands of dollars in a single Bitcoin. This divisibility is especially significant given BTC’s relatively high value compared to many other assets.

Where can you buy bitcoin?

The market offers a variety of platforms related to cryptocurrencies where you can conduct transactions and check BTC quotes in PLN or USD. Bitcoin, along with numerous other cryptocurrencies, can be acquired in several ways, including:

- Cryptocurrency Exchanges – platforms like Coinbase, Kraken, Binance, and Kanga Exchange offer Bitcoin purchases against traditional currencies such as the dollar, euro, or Polish złoty.

- Cryptocurrency Brokers – these services facilitate the buying and selling of BTC using conventional payment methods, such as credit cards or bank transfers.

- Bitcoin ATMs – these allow for Bitcoin purchases through cash deposits.

- P2P (Peer-to-Peer) transactions – secure transactions enable direct BTC purchases from another individual within the blockchain user community.

- Currency Exchanges – outlets like Kanga Kantor let you exchange cash for Bitcoin and other cryptocurrencies—and vice versa.

Looking for an easy-to-use platform to buy BTC? Register for free at Kanga Exchange and learn more about purchasing Bitcoin in Poland from our blog.

FAQ — BTC exchange rate

How much does bitcoin cost today?

The current price of 1 bitcoin isi 68 592.84 USD

Where to store bitcoins?

Bitcoins can be stored in a dedicated wallet or on the Kanga Exchange cryptocurrency platform.

What is bitcoin based on?

Bitcoin operates on blockchain technology, a distributed system where each transaction is recorded across multiple network nodes, safeguarding against data falsification.

How many bitcoins are there?

The total supply of Bitcoin is capped at 21 000 000.

How to buy your first bitcoin?

Purchase your first Bitcoin on Kanga Exchange by following these steps:

1. Log into your Kanga Exchange account.

2. Select your desired market type (e.g., BTC/oUSD).

3. In the “Buy” tab, enter the price and quantity you wish to purchase. You can accept an existing offer or create a new one.

4. Click the “Buy” button to place your order. Your orders can be tracked on the “Open Orders” and “My Orders” pages for the last 24 hours.

How to buy bitcoin with zlotys?

Purchasing Bitcoin with zlotys is straightforward: simply exchange cash for the cryptocurrency at an exchange office. This can be done at Kanga Exchange’s partner, Kanga Kantor, by following these steps:

1. Find a suitable cryptocurrency exchange on kangakantor.pl.

2. Negotiate the transaction details with the operator, including the amount of Bitcoin you wish to purchase.

3. Open the Kanga Wallet app and select the “CANTOR” tab.

4. Press the “GENERATE CODE” button and provide the generated code to the operator, confirm the transaction on your phone, and then hand over the cash to the exchange office staff.

5. The Bitcoin will be credited to your account shortly thereafter.

For more detailed information, refer to the associated article.

Who created bitcoin?

Bitcoin was invented by an individual or group of individuals under the pseudonym Satoshi Nakamoto.