Business account verification (KYB) in Kanga

Written by

Ewelina Skorupka

Published on

Kanga cryptocurrency exchange offer is addressed not only to retail clients, but to business customers as well. However, if you want to take the full advantage of the features provided by the platform, it is necessary to conduct the Know Your Business (KYB) verification check, ensuring compliance with anti-money laundering regulations (AML).

In this guide we will lead you step by step through the business account verification process in Kanga, so that you are able to take the full advantage of the potential hidden in cryptocurrencies.

Why is KYB check crucial for your account?

KYB verification – step by step

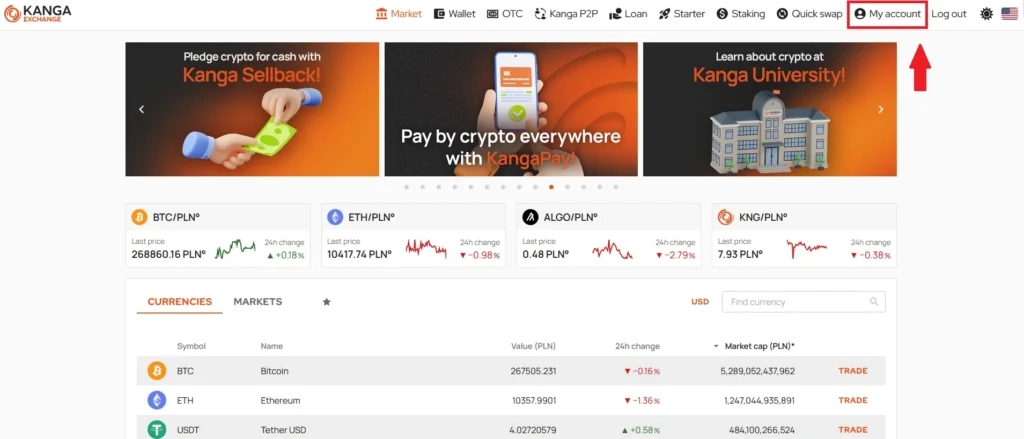

Log into trade.kanga.exchange panel to begin the verification process. If you do not yet have an account, navigate to the step by step guide to set it up.

Go to “My account” in the top right corner:

Click the button in the top right corner

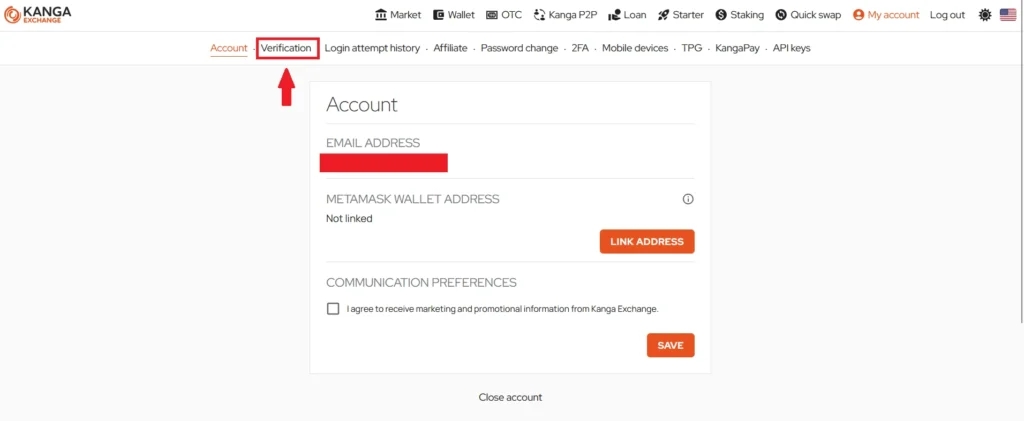

Next, go to the “Verification” tab:

”Verification” button is situated in the top panel

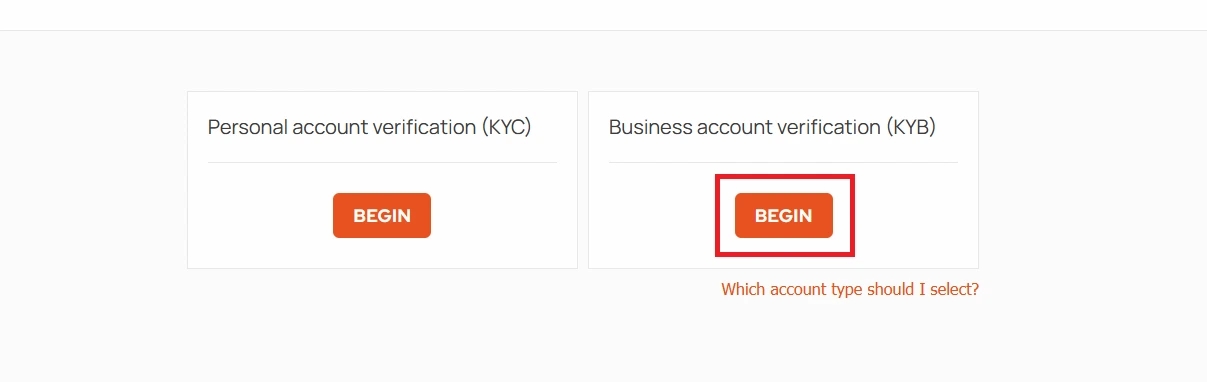

You will be now requested to choose the verification option: for personal account or for business account. For business customers, pick KYB:

KYB is verification check for entrepreneurs and business customers

To perform business verification you need to prepare a number documents. You will need:

- the copy of entry into the National Court Register (KRS) or the Central Register and Information on Economic Activity (CEDIG)

- the copy of entry into the Central Register of Beneficial Owners (if the company is obliged to be entered into the CRBR)

- a copy of the account administrator’s identity card

- a residential verification document of the account administrator

- copies of ID documents identifying beneficial owners

After reading information on the required documents press „Next”

You will be redirected to a form listing 9 steps. The rules for filling it in are described below:

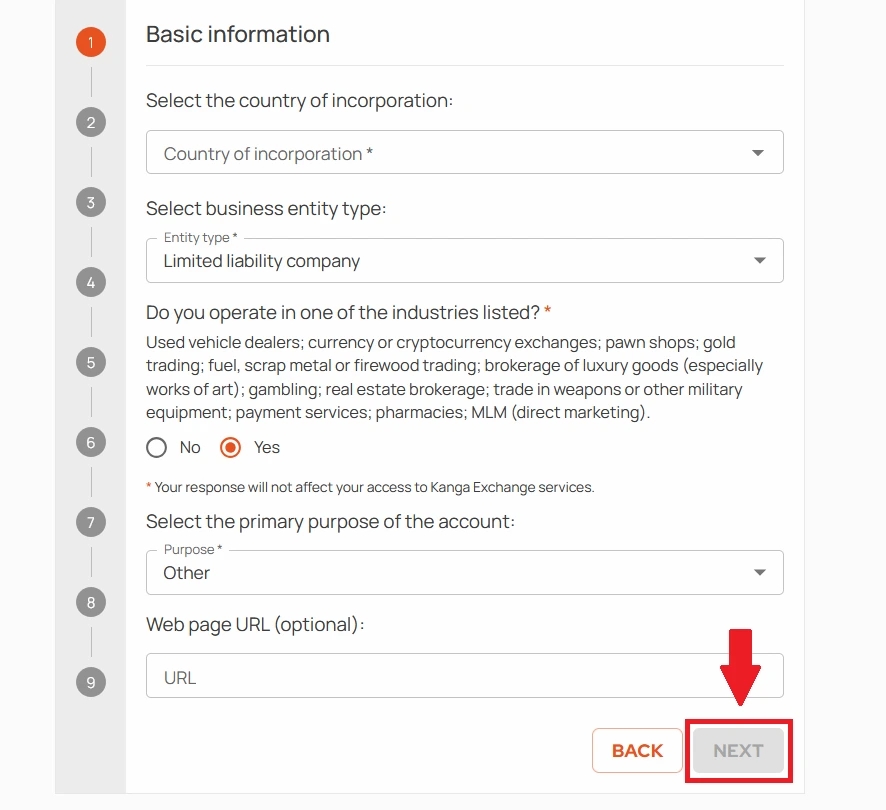

Step 1: Background information

In this step of the KYB verification, please provide basic information on your business including the country of registration, legal form, and confirm if you conduct business in one of the following industries:

Used cars dealerships; currency or cryptocurrency exchanges; pawn shops; gold trading; fuel, scrap metal or fuel trading; luxury goods brokerage (especially in art pieces); casinos or other gambling-related venues; real estate; arms or other military equipment trade; payment services; pharmacies; direct marketing (MLM).

Additionally, provide the purpose for setting up the exchange account for your company and, optionally, the website address associated with your activities.

After completing this data press „Next”.

Sample form

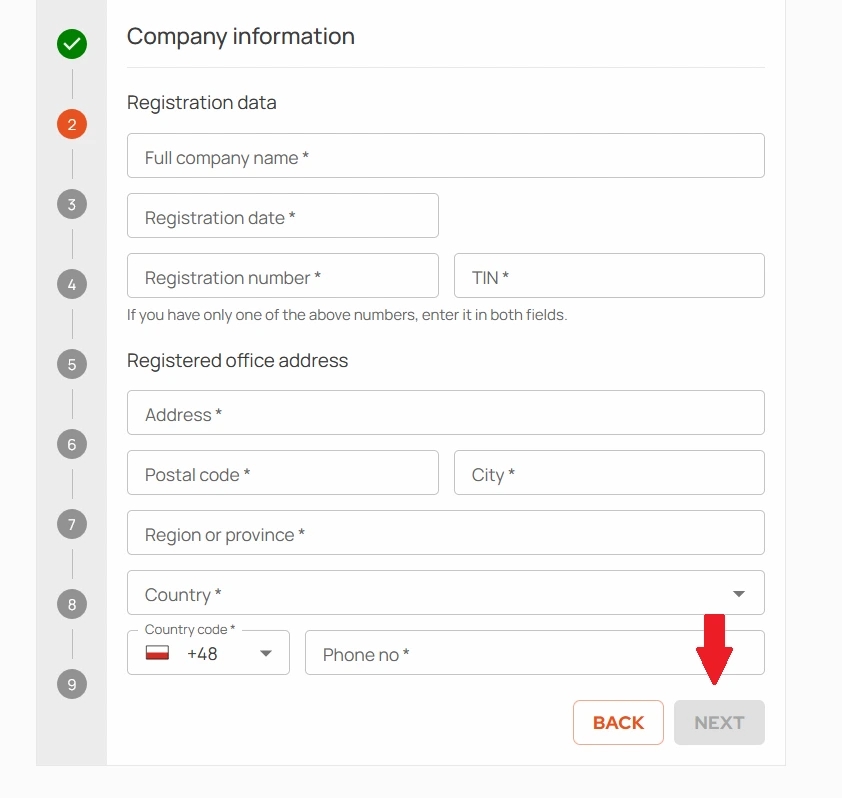

Step 2: Company registration details

In this section you will be requested to provide basic data of your business activity: name, registration date, KRS (or REGON) number, NIP number and the registered office address.

After completing this data press „Next”

Proceed to the third section of the KYB form

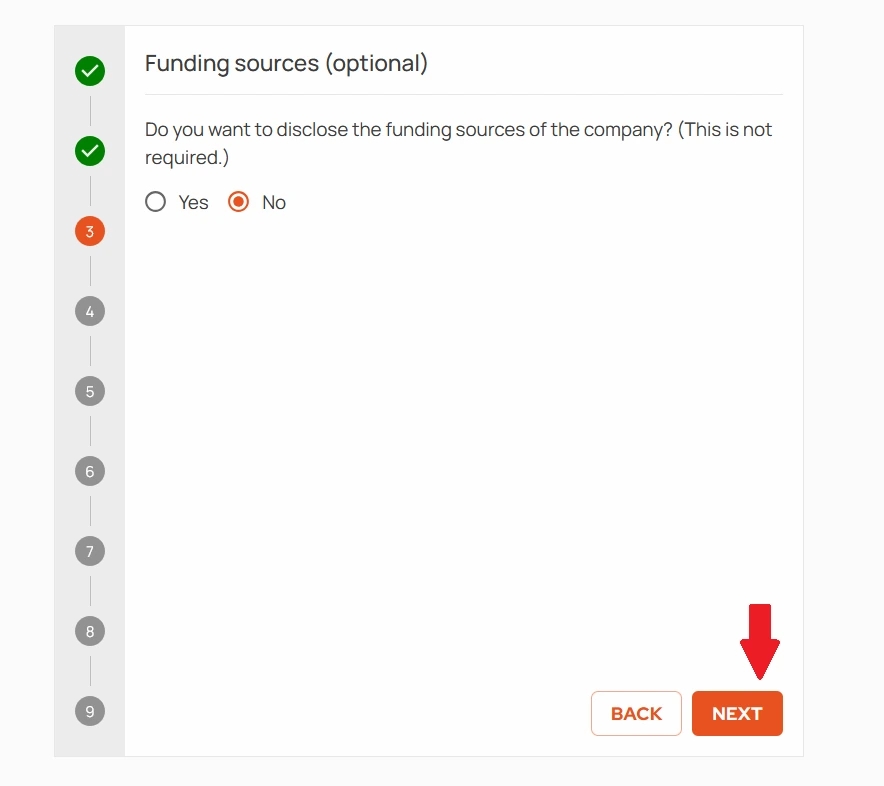

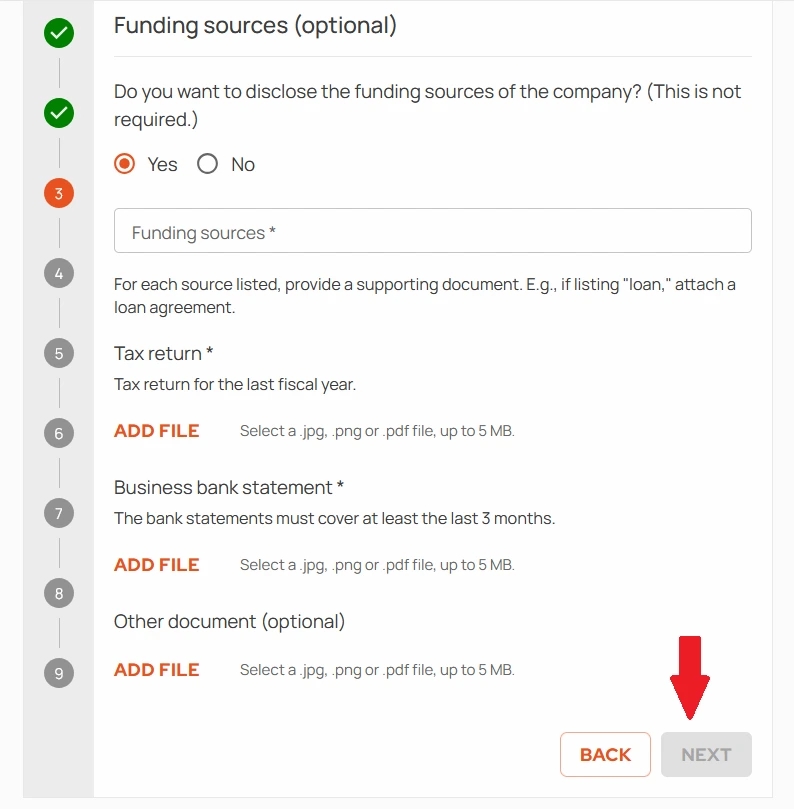

Step 3: Sources of finance

Third step is optional; if you want to speed up the registration process select „No”. This way you will not be required to indicate the funding sources of your company.

Click ”No” and continue

If you wish to provide this (voluntary) data, it will be necessary to prepare its short description and uploading the following attachments: tax declaration, business bank statement and another document (optional).

Please note! Each specified source needs to have a corresponding document attached. For example, if you enter ”loan”, upload the loan agreement.

Extended procedure for specifying financial business sources

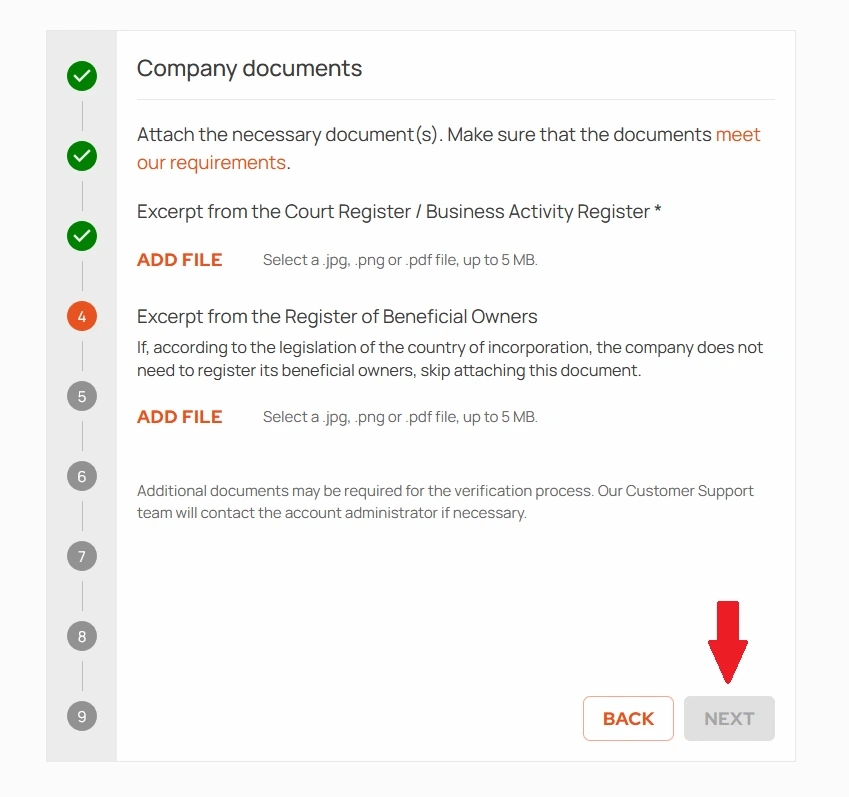

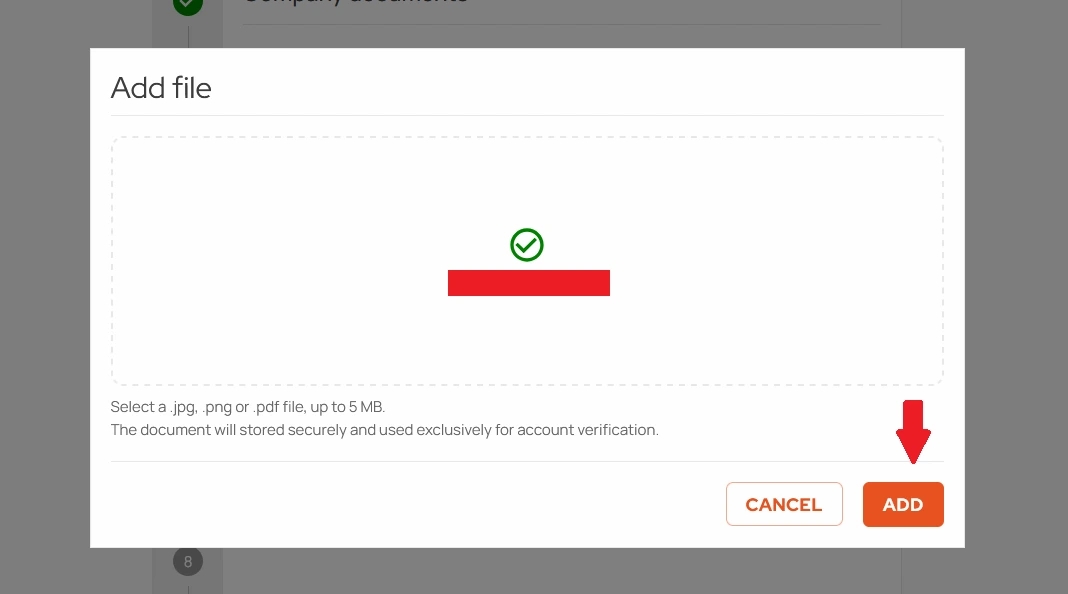

Step 4: Company documents

In this step you will be requested to upload KRS or CEIDG statement. The file should be submitted in JPG, PNG or PDF format and may not exceed 5 MB.

Please note! During the verification process you may be requested to provide additional documentation. In such case, our customer service will contact the account administrator.

After uploading relevant attachment press ”Next”

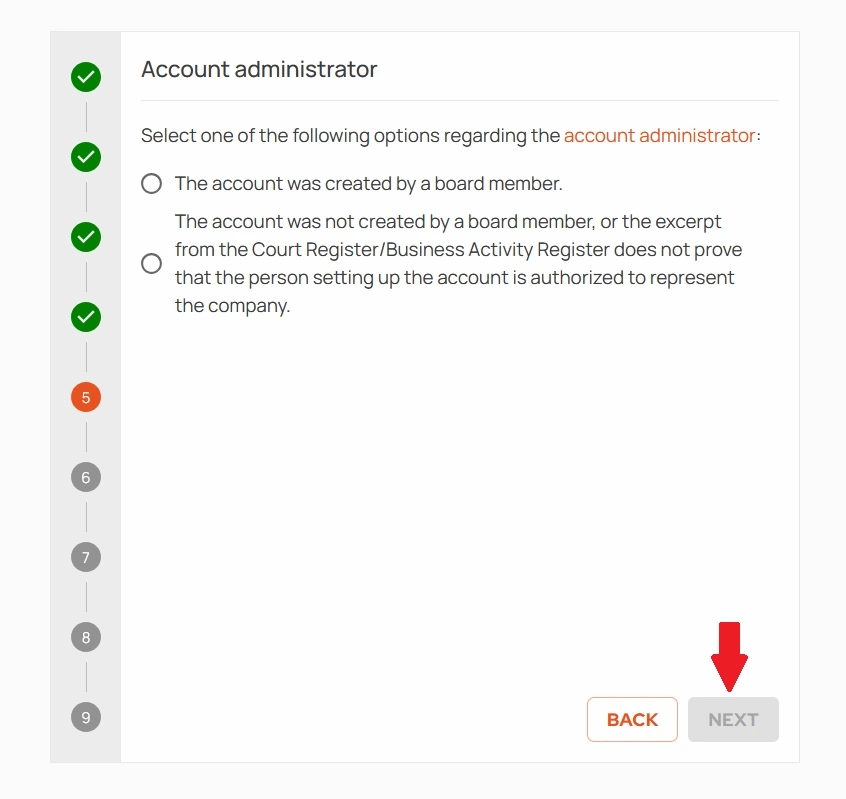

Step 5: The exchange account administrator

In this step you must indicate the ”exchange account administrator”, namely, the person authorised to represent the business entity, owning the exchange account and acting as its technical user.

The administrator of the account can be:

- board member (disclosed in the commercial register)

- or an empowered representative with a separate authorisation (also attached to the verification request).

Select one of the options and click ”Next”

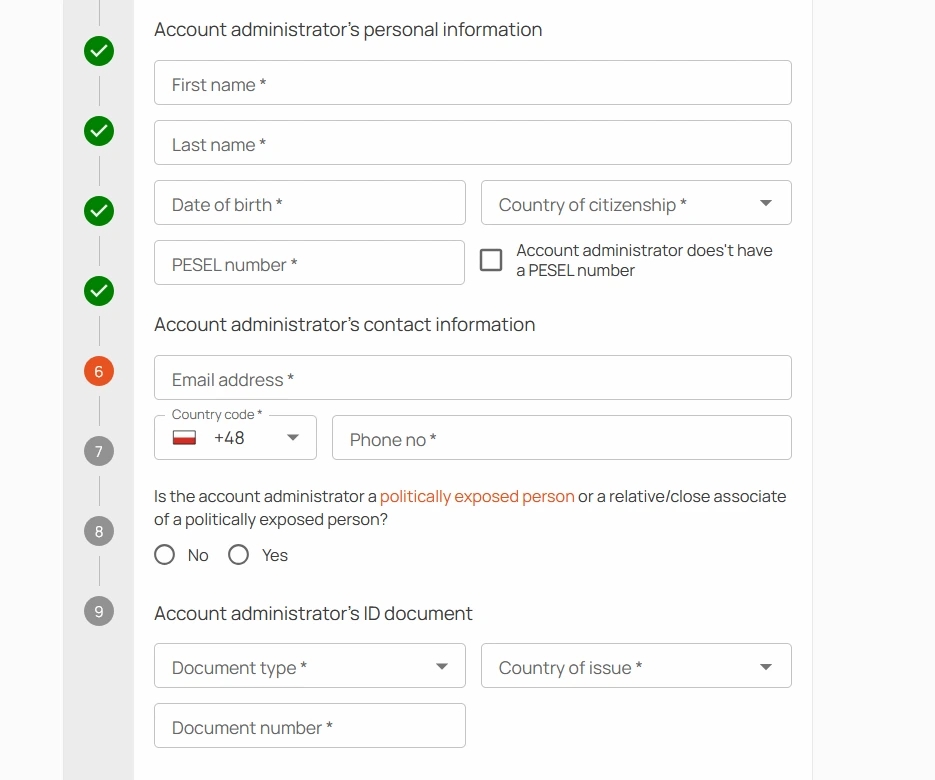

Step 6: Administrator’s data

Step 6 requires the administrator of the exchange account to confirm their personal data, including contact data and identity document details. When all fields are populated, press ”Next”.

Pay close attention to the information, if the account administrator is a ”politically exposed person”.

Specify administrator’s data and proceed to step 7

Please note you will be requested to upload the scans of specific pages of the identification document upon choosing its type. In case of the identity card, that will be its separately attached front and back.

Upload the scans of your identity card (or passport)

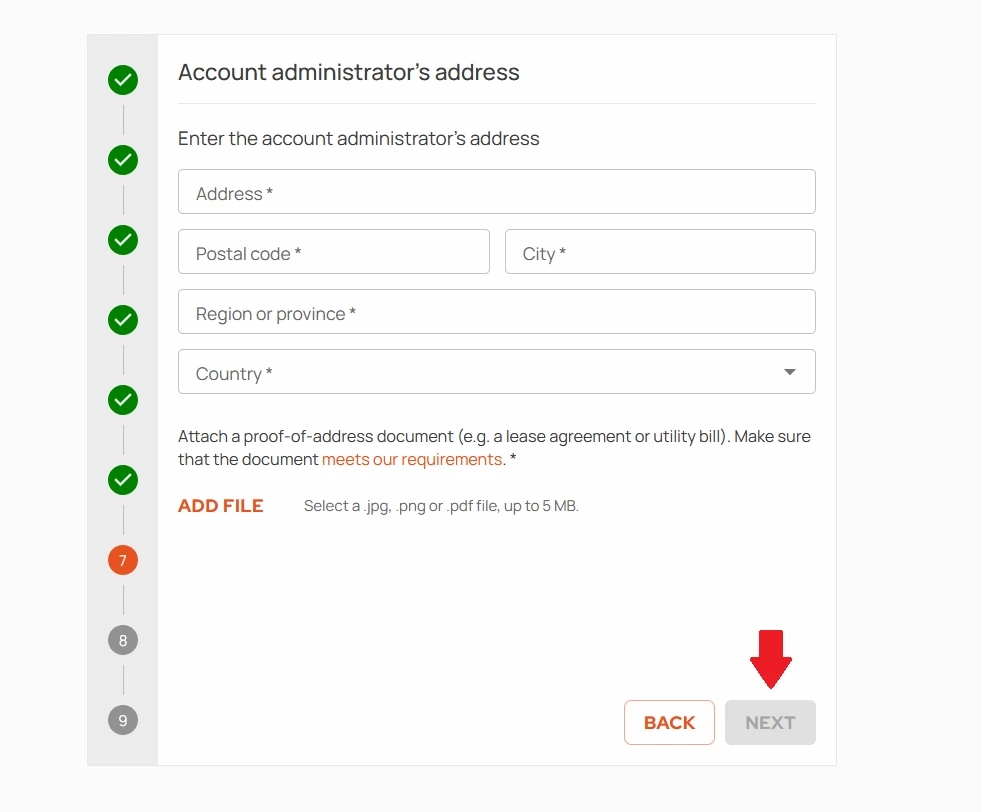

Step 7: Administrator’s address details

Specify the account administrator’s home address and the document confirming it (the lease agreement or a utility bill). The document must meet several requirements:

- Name and surname – the same as in the identification card,

- Address – the same as the one specified on this screen,

- The document must be issued within the last 6 months,

- Visible data, address, issue date and the issuer.

Click ”Next” after filling in the data and uploading the document confirming the address

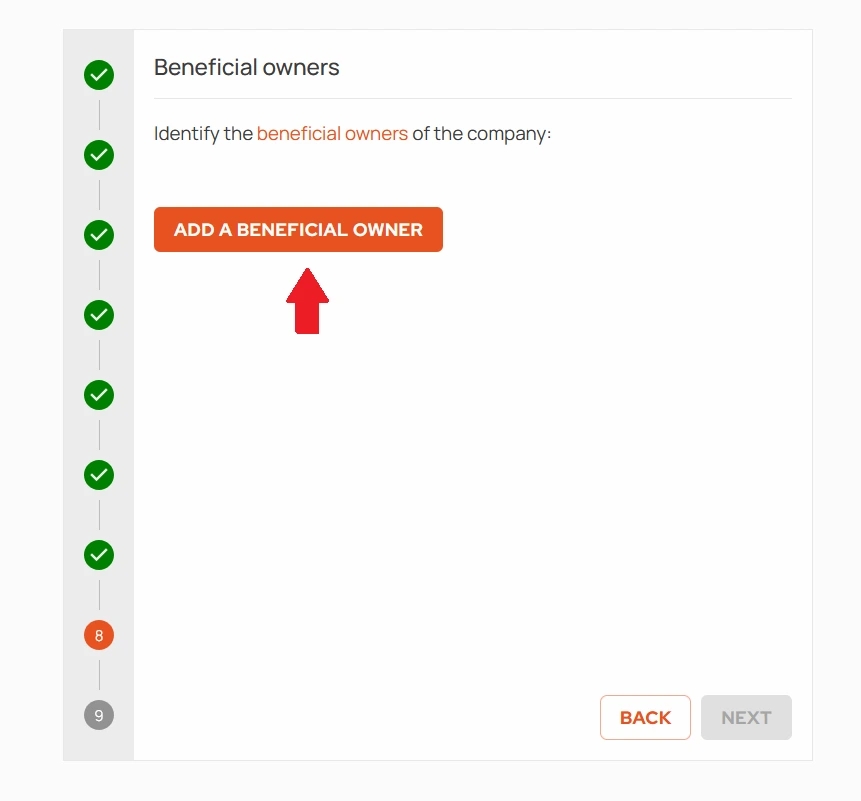

Step 8: Real beneficiaries

The real beneficiary is a natural person who is, either directly or indirectly, in control or authorised to exercise decisive influence over a given entity, notably including owning more than 25% shares/stocks or total number of votes in the governing body of a particular company.

In this step you specify the real beneficiary. If it is you, tick the box next to:

”After learning about the ”real beneficiary” definition, I declare that I do not remain under anybody’s influence or control, I act independently and I am familiar with the consequences of setting up the account and its purpose, therefore I am the real beneficiary myself (there is no third party)”.

Tick the box and click „Next”

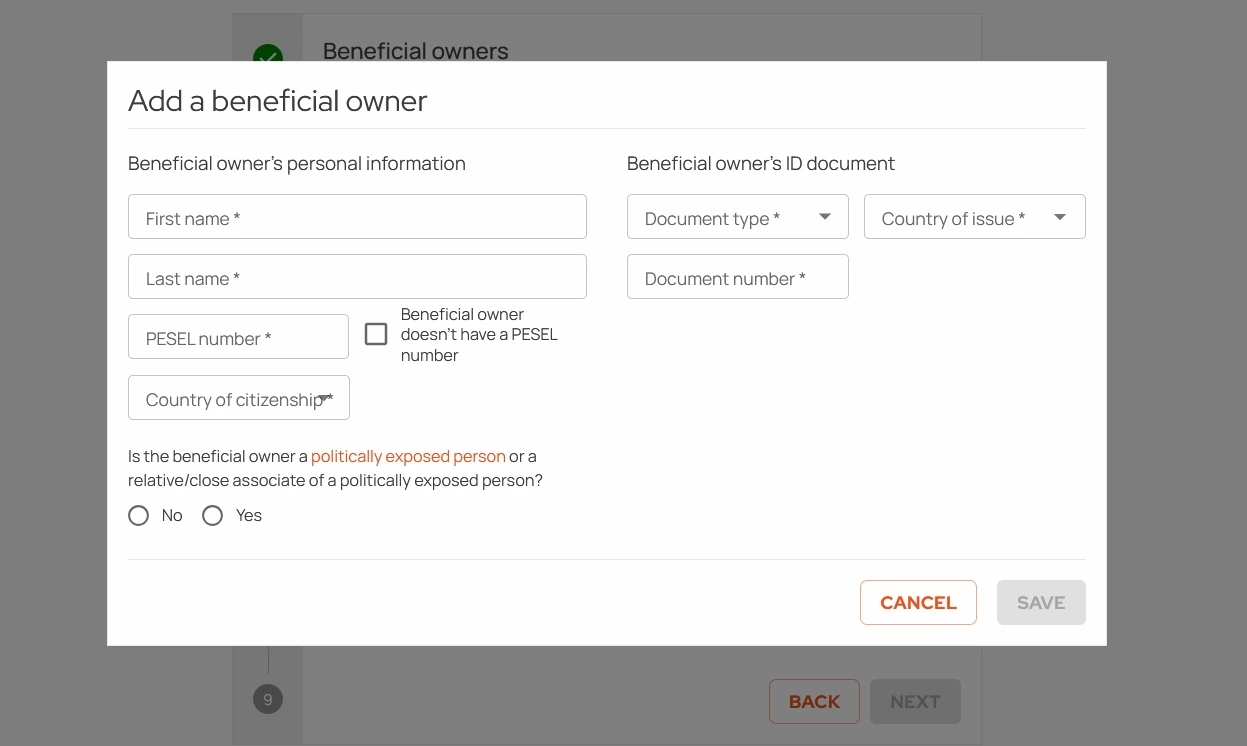

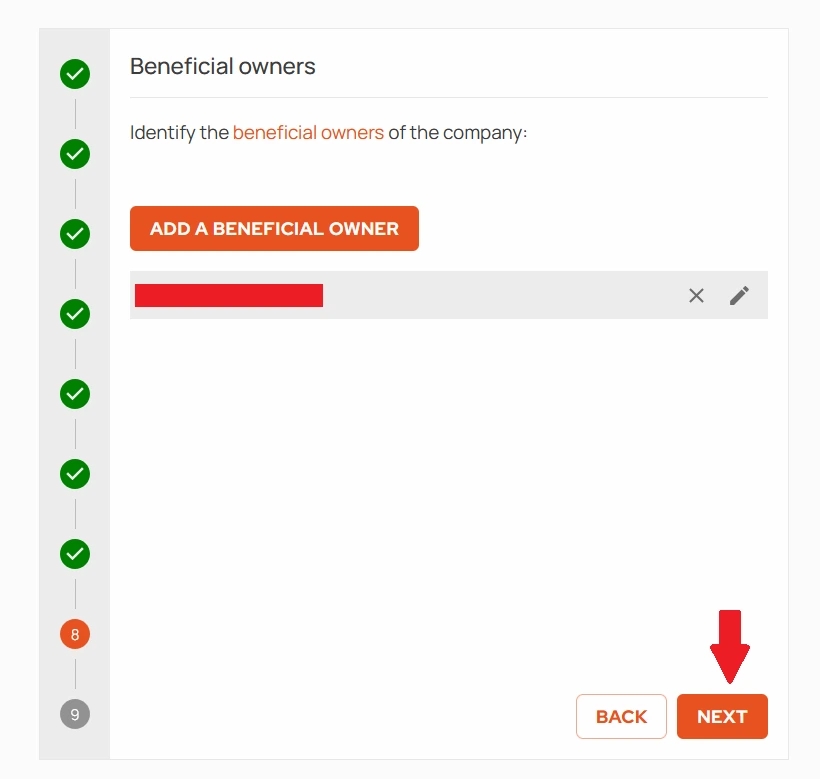

Otherwise, press ”Add Beneficiary” and provide their personal and identity document data.

Adding beneficiary

Step 9: Summary

Congratulations! You have just went through the KYB verification phase. After correctly completing the form click ”Send”.

You will be informed by e-mail of the outcome of the verification. It usually takes 2 working days for the majority of accounts to be verified however, in special cases, the waiting period can be extended.

Press ”Send” to complete verification

If you would like to update information provided for KYB verification, please contact Kanga at [email protected].