SWAP - a quick exchange of cryptocurrencies

Written by

Kanga

Published on

You have surely come across the concept of SWAP. In this article, you can read about the mechanism itself and its relation to cryptocurrencies.

SWAP – what is that?

We are looking to define SWAP a little more precisely.

The easiest way to explain the mechanism itself is to analyze what’s going on in the exchange. Currency SWAP is an agreement between a bank and its client, where parties are obliged to exchange a specific amount expressed in one currency for its equivalent in another currency. For instance, Polish zlotys for American dollars. However, after the expiry of the time specified in the contract, the parties are to make a return exchange.

SWAP can also be used for speculation – help use earn means by exchanging one currency to another. Of course the risk of loss is involved. For example, if after a certain amount of time, in the case of an early termination of the contract, the re-exchange rate will be unfavorable to us.

SWAP at the blockchain level

SWAP on cryptocurrency market occurs when a given digital currency project decides to change the blockchain it is currently based on to a different network. So the blockchain is replaced. This phenomenon occurs most often when the creators of a given token or cryptocurrency decide that the original assumptions about blockchain do not work, e.g. the network turns out to be too slow in operation or often clogs up. Then they transfer their assets to another chain.

SWAP centralized

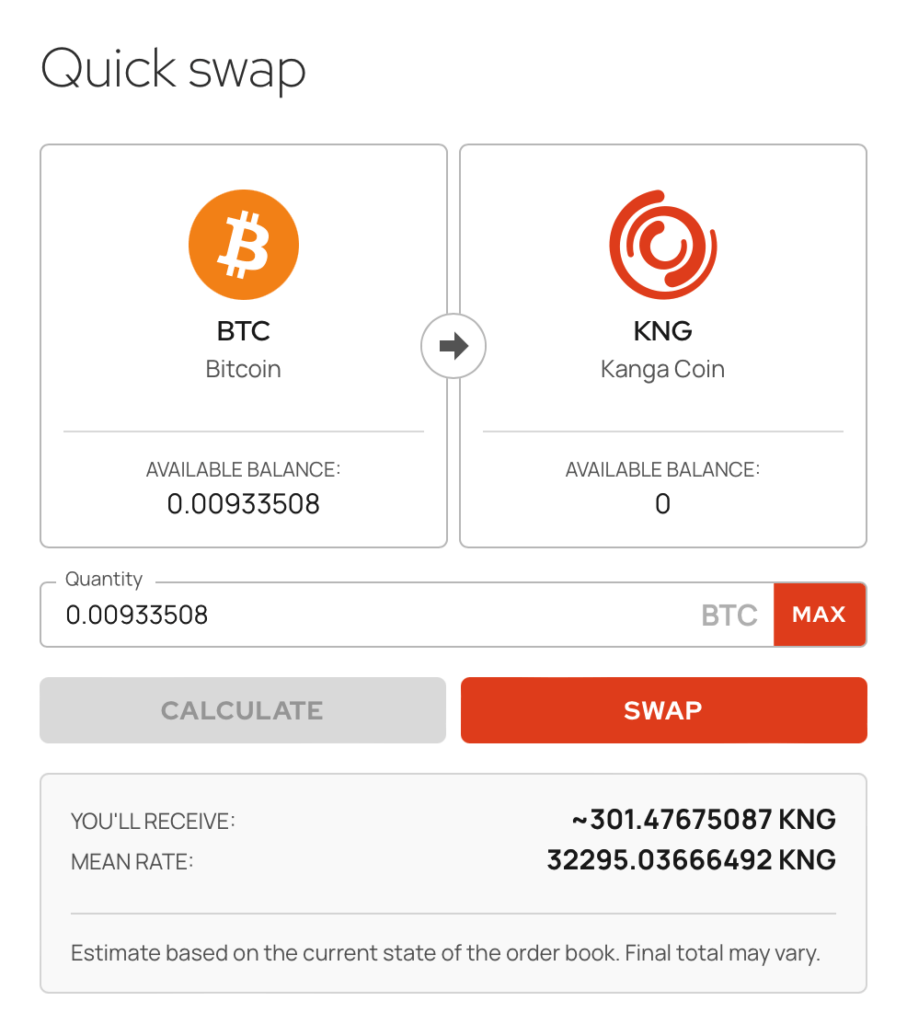

SWAP on a centralized exchange such as Kanga Exchange is a quick exchange of one cryptocurrency for another. In this case, it doesn’t matter what blockchain the cryptocurrency is on. It is essential that it is listed on the exchange. There does not have to be a direct market on it (e.g. you do not see the oPLN / oEUR pair), because the SWAP mechanism will find intermediate markets (e.g. BTC / oEUR and BTC / oPLN) and will make the appropriate background exchange.

Thanks to this mechanism, the lack of a direct market is not a problem – it is enough that there will be an intermediate market on the exchange. Then the SWAP mechanism will automatically make the transaction in the background, and it will present to you the final effect of the desired exchange.

SWAP in a few steps

How does SWAP work? Let’s use our exchange as an example.

First step after logging in to your account is to pick the currency on the left (the one you have) and on the right (the one you wish to acquire). Then, you find out how much currency X you will get for currency Y.

Now the only thing you have to do is to click on the ‘SWAP’ button.

As you can see, the exchange is fairly simple. No charts or order book.

Cryptocurrency market is gaining popularity day by day. As a result, Fintech companies race to provide simple, clear solutions for their users. SWAP is one of them, even though its source lies in pretty complicated centralised exchange systems, like Uniswap or Sushiswap. It gives our users new possibilities – e.g. buying popular cryptocurrencies (ex. BTC/ETH), purchasing stablecoins (ex. oPLN/oEUR) and buying tokens (ex. BEN/oPLN).

Jacek Walewski on behalf of Kanga Exchange