In the world of technical analysis, support and resistance levels are key concepts that help investors understand where prices may slow down, reverse, or continue a trend. These levels act like invisible barriers that prices struggle to break through.

Support Level

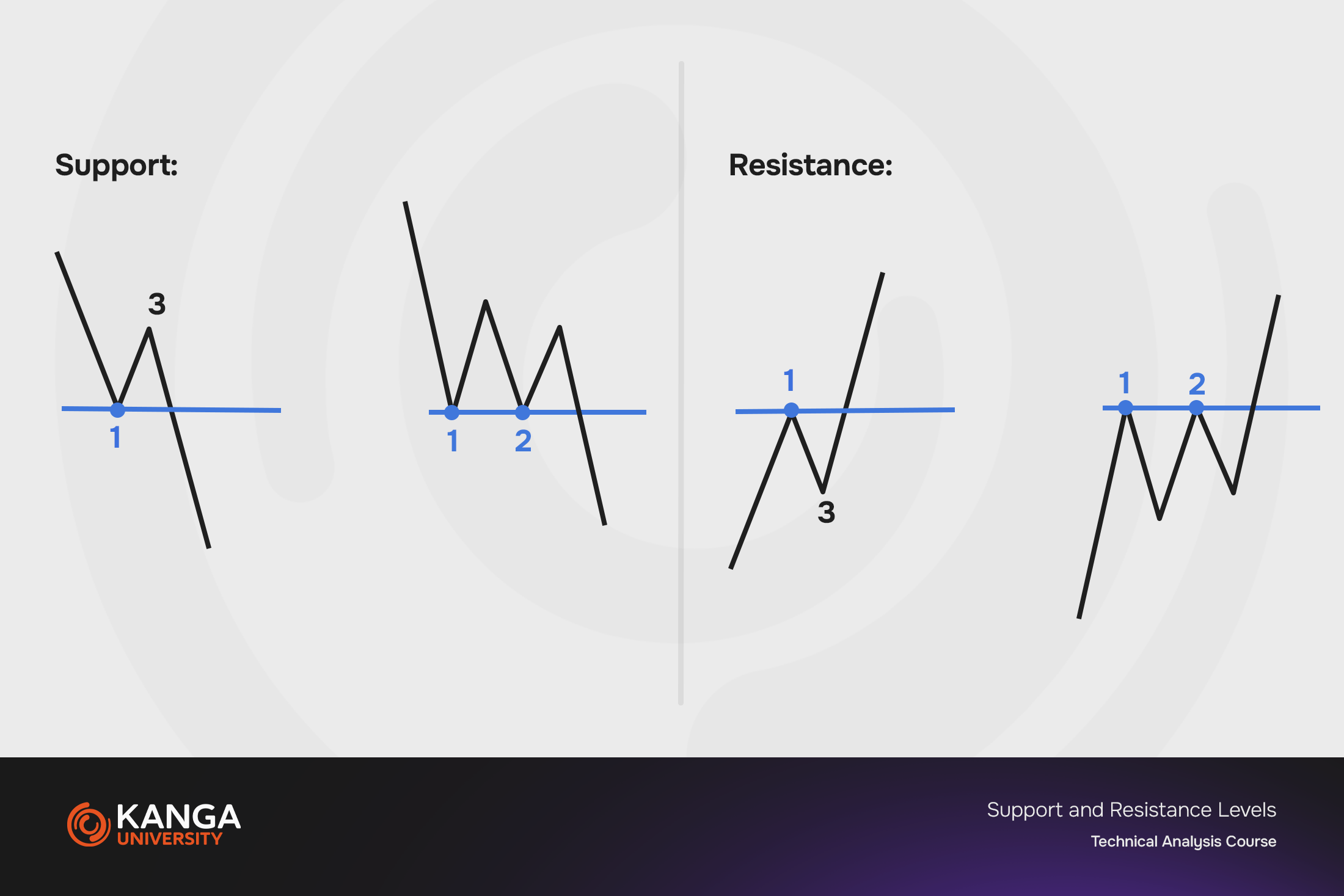

A support level is a price point where buying interest is typically strong enough to prevent further price declines. It acts like a “floor” from which the price tends to bounce upward. Support forms when buyers enter the market in response to lower prices, increasing demand and halting the decline.

-

Identifying Support: To determine support, look for previous price lows on the chart where a downward move stopped and reversed upward.

-

Significance and Confirmation: A support level becomes more meaningful if the price has stayed away from it for a long time. High trading volume during a bounce off the support level further confirms its strength.

Resistance Level

Resistance, in contrast to support, acts like a “ceiling,” preventing the price from rising further. It forms when selling pressure outweighs buying, halting upward momentum.

-

Identifying Resistance: To find resistance, look for previous price highs where an upward move stopped and reversed downward.

-

Significance and Confirmation: Like support, resistance is more significant if the price has not approached it for an extended period. High volume during a test of resistance also confirms its importance.

Breakouts Through Support and Resistance

Sometimes, despite the presence of these levels, the market breaks through them—usually signaling a trend reversal or continuation.

-

Breaking Support: When the price falls below a support level and stays there, it may indicate a continuation of a downward trend. The broken support often becomes new resistance. A breakout should be confirmed by increased volume.

-

Breaking Resistance: If the price breaks above resistance and holds, this signals a potential continuation of the upward trend. The former resistance then becomes new support. Again, increased volume confirms the breakout.

Trading Strategies

Trading Strategies

-

Buying at Support: Consider buying when the price approaches a strong support level and shows signs of bouncing.

-

Selling at Resistance: Consider sellingwhen the price nears resistance and shows signs of reversal.

-

Breakout Trading: A breakout of support or resistance can serve as a signal to open long or short positions, depending on the direction of the breakout.

Summary

Understanding support and resistance levels is essential for any investor using technical analysis. These levels offer valuable clues about potential market turning points and can help in making informed investment decisions. Always remember to confirm these levels with other indicators and volume analysis.

Trading Strategies

Trading Strategies