Recognizing market trends is one of the fundamental skills every investor and trader must develop. Trends indicate the direction in which the market or the price of a specific financial instrument is moving. They can significantly impact investment decisions. In this lesson, you will learn how to identify different types of trends and understand their significance for your investment strategy.

What Is a Trend?

A trend in financial markets is the direction in which asset prices move over a certain period. Trends can be upward (bullish), downward (bearish), or sideways (horizontal), and are a key element in forecasting future price movements.

Types of Trends

-

Long-term (primary) trend: Lasts from several months to several years and shows the overall market trajectory.

-

Medium-term (secondary) trend: Lasts a few months and often serves as a correction within the primary trend.

-

Short-term (tertiary) trend: Lasts from a few weeks to a month, is the most volatile, and the hardest to predict.

How to Identify a Trend?

-

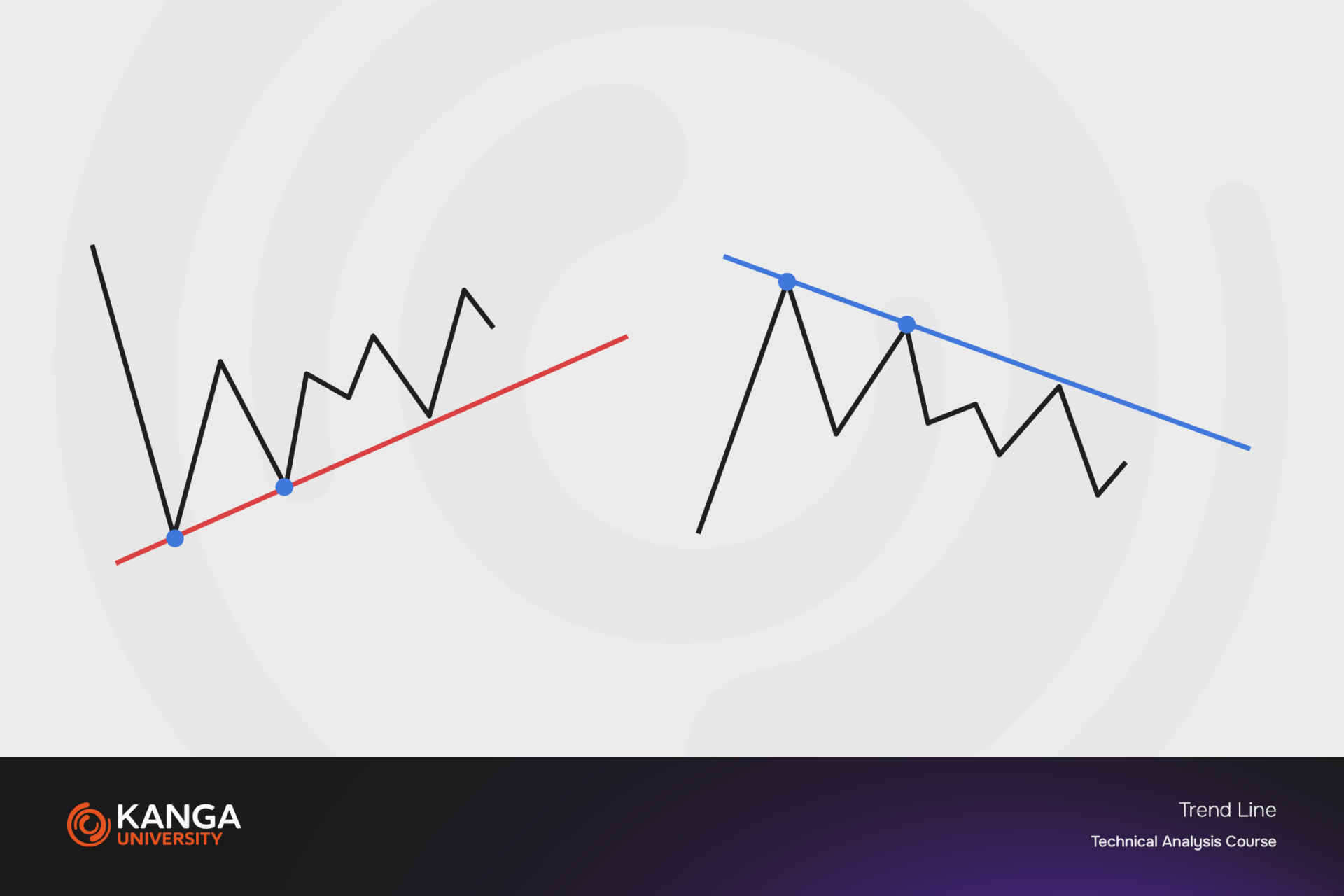

Drawing trendlines: The simplest way to identify a trend is to draw a line connecting the lows in an uptrend or the highs in a downtrend. If the trendline slopes upward, it’s an uptrend; if it slopes downward, it’s a downtrend.

-

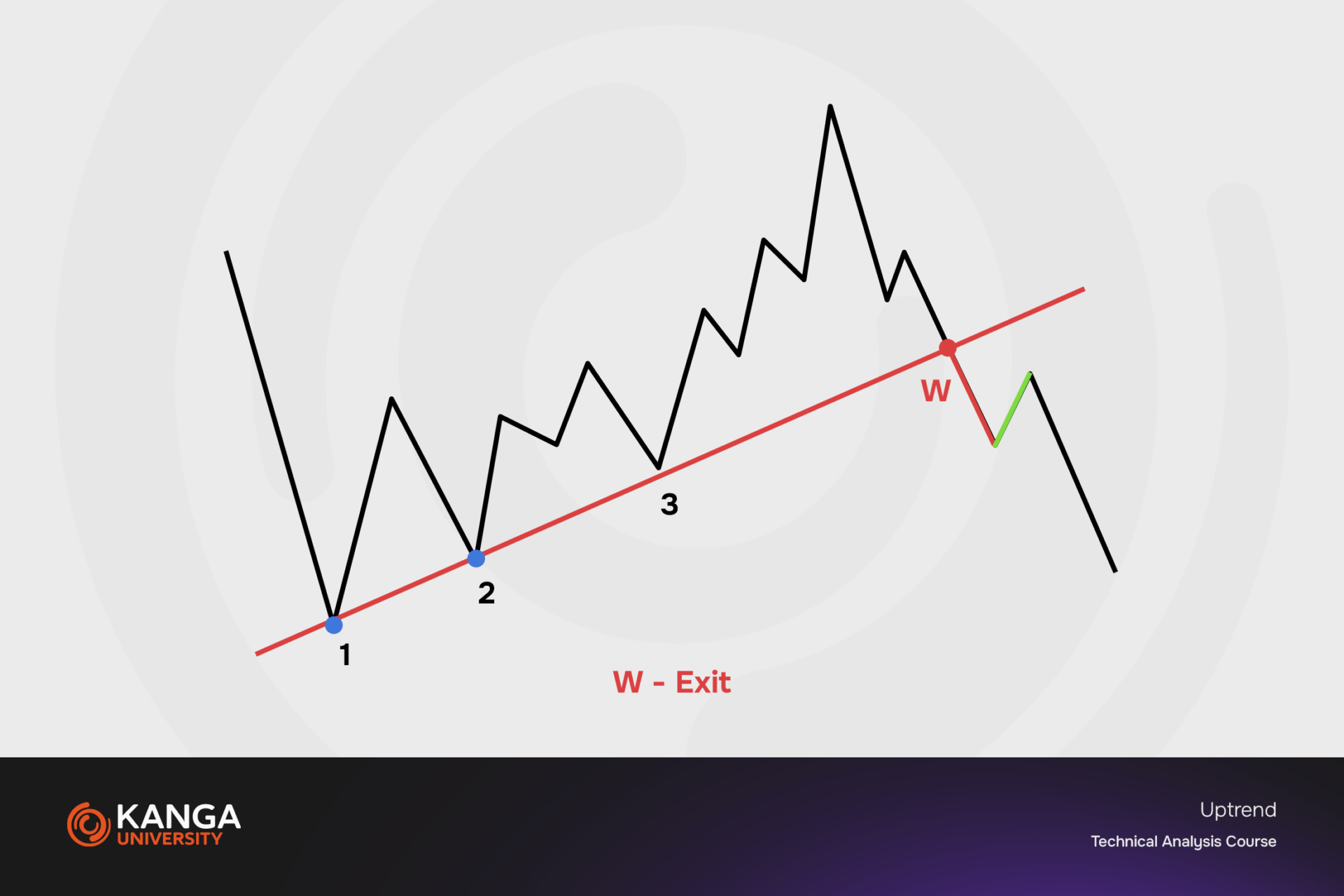

Uptrend: Characterized by higher lows and higher highs. An uptrend indicates that buyers have the upper hand over sellers.

-

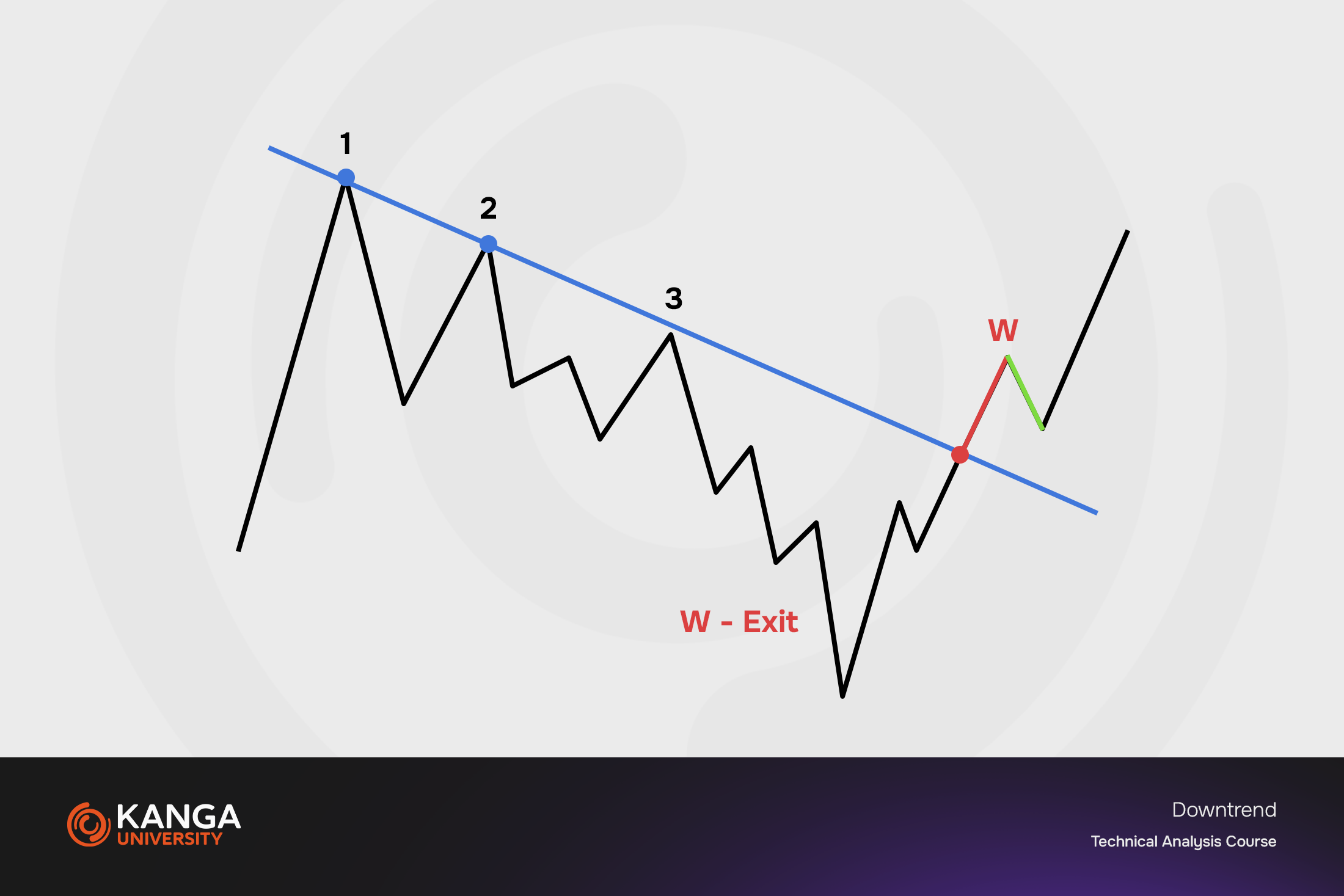

Downtrend: Characterized by lower highs and lower lows. In a downtrend, sellers dominate the market.

-

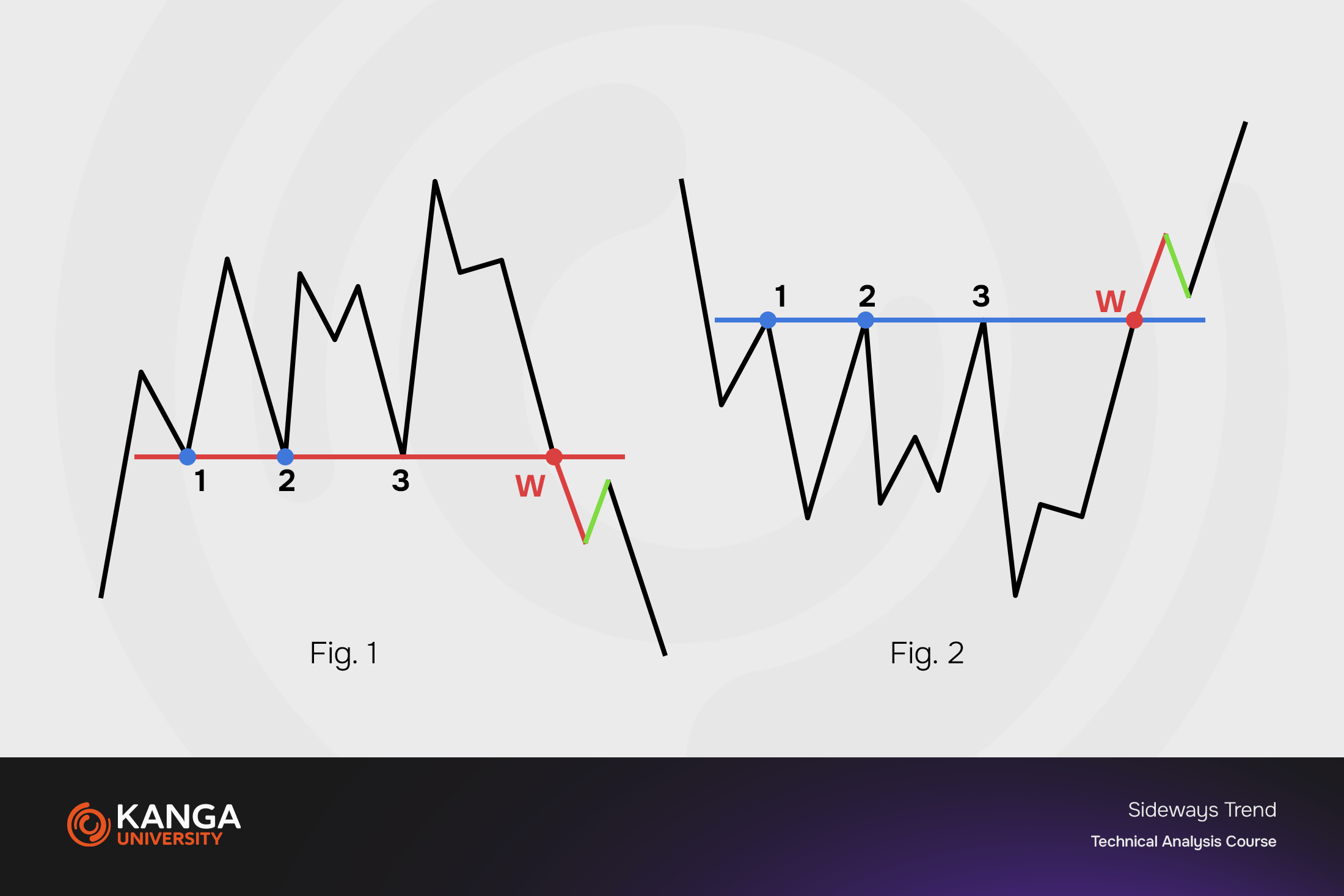

Sideways trend (horizontal): Occurs when prices fluctuate within a certain range without a clear direction. This suggests a balance between buyers and sellers.

Why Trends Matter

Why Trends Matter

-

Investing in the direction of the primary trend increases the likelihood of success.

-

Trends can serve as a guide for entry and exit points.

-

Identifying a trend helps spot corrections, which can offer good entry opportunities.

Practical Tips

-

Don’t fight the trend: Investing against the primary trend is highly risky.

-

Use trendlines: Regularly draw trendlines on your charts to understand the current market direction.

-

Watch for trend reversals: A change in trend may signal new investment opportunities or the need to protect your portfolio.

Summary

Identifying and understanding trends is essential for every investor. Investing in line with the primary trend, carefully watching for medium-term trend changes, and avoiding investments against the trend are principles that can significantly increase your chances of success in the financial markets. Remember: “The trend is your friend”—this saying is one of the most important investment maxims.

Why Trends Matter

Why Trends Matter