Technical analysis is an essential tool for every stock market investor, allowing for the assessment of price movements and market trends. A key component of this analysis is the use of charts, which help visualize historical data and forecast future price changes. In this lesson, we’ll look at three basic types of charts used in technical analysis: line charts, bar charts, and candlestick charts.

Line Chart

The line chart is the simplest type of chart, showing only a series of closing prices over a specific time period, connected by lines. Its main advantage is its simplicity and clarity, which allows for a quick assessment of the general market trend. Line charts are especially useful for long-term investors looking for an overall price trend without delving into detailed market fluctuations.

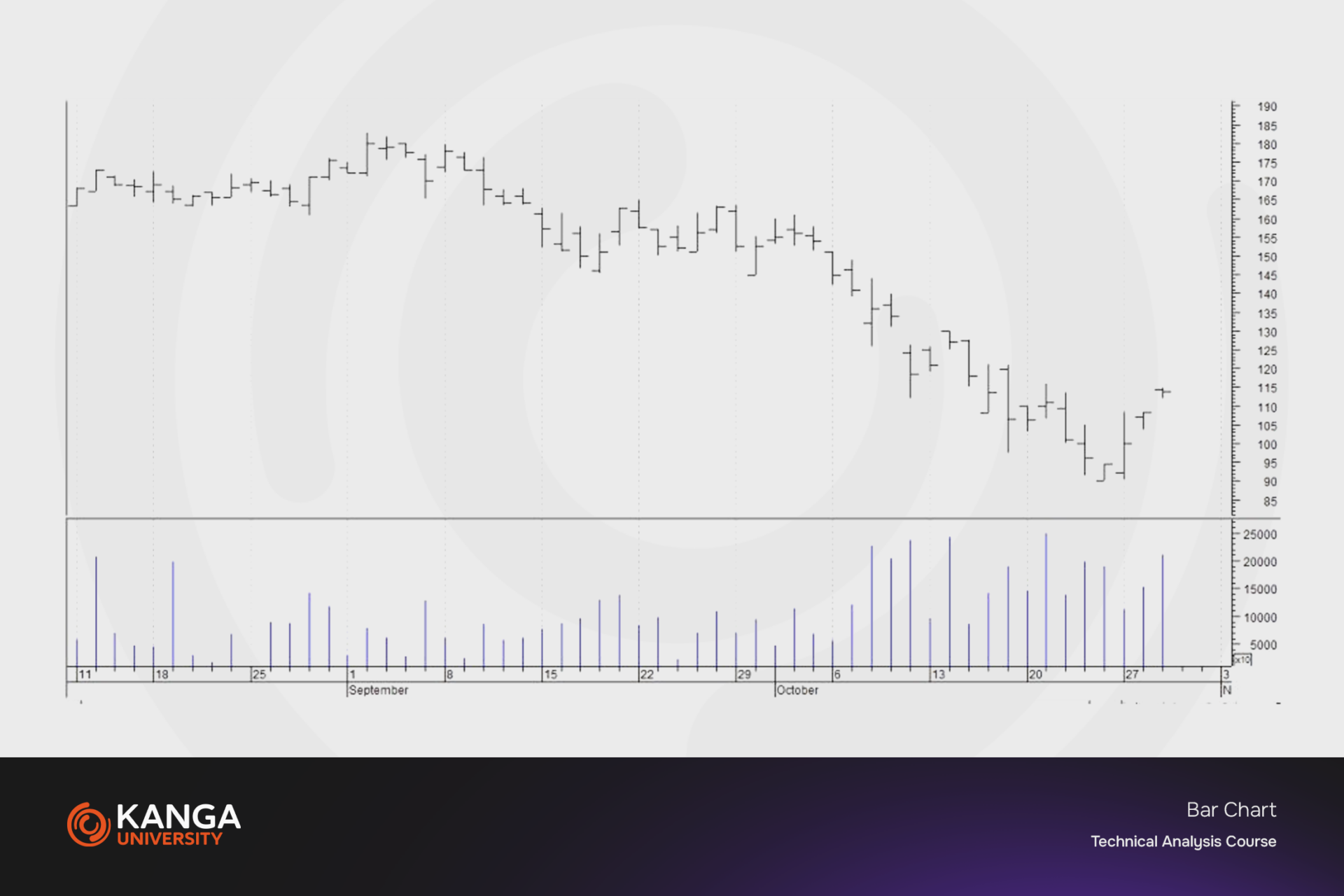

Bar Chart

The bar chart, also known as the OHLC chart (Open, High, Low, Close), provides much more information than the line chart. Each “bar” on the chart represents four key data points for a given period: the opening price, closing price, high, and low. This allows investors not only to assess the direction of price movement but also to understand its volatility during the given period. Bar charts are extremely useful for medium- and short-term traders who base their decisions on more detailed analysis of price movements.

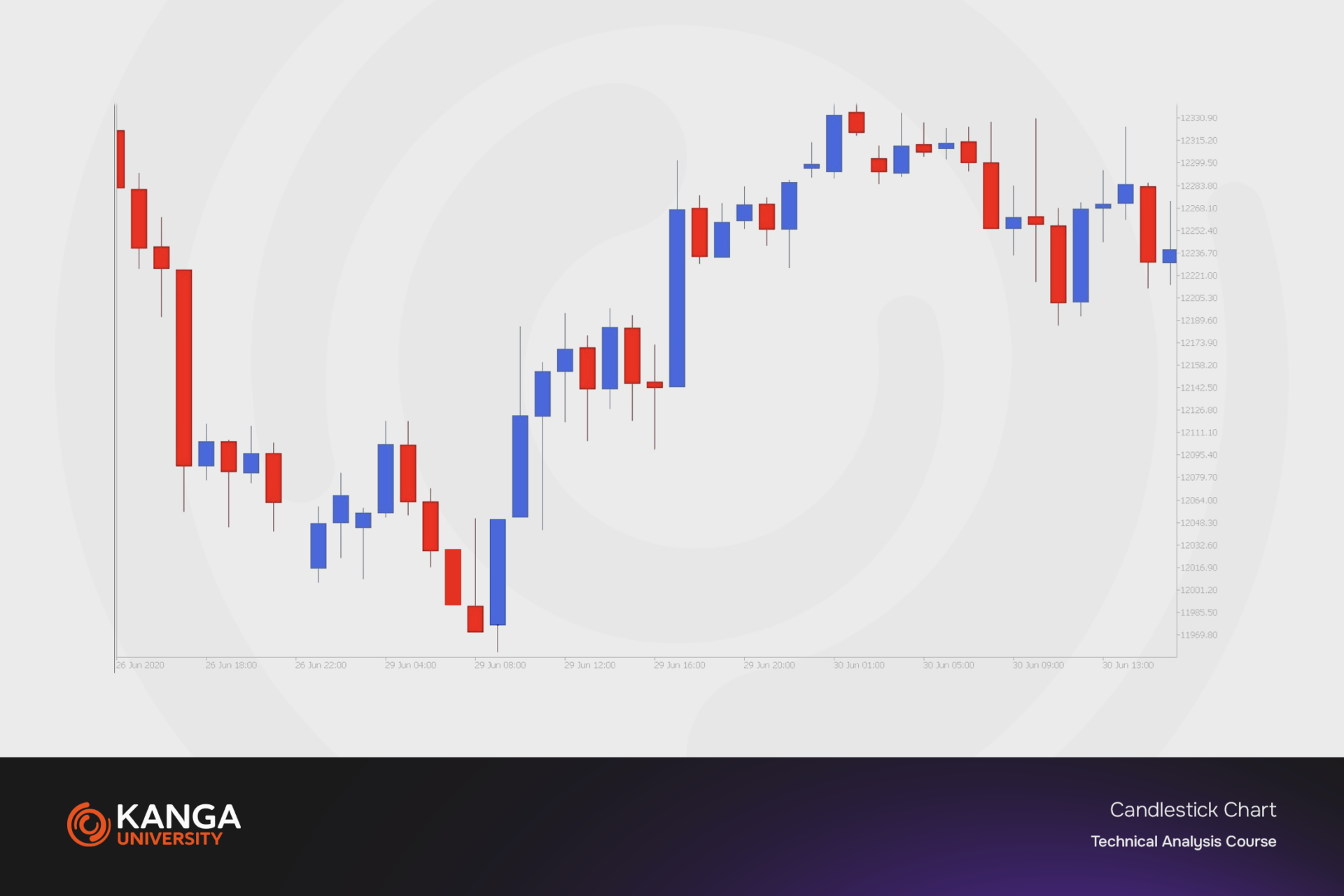

Candlestick Chart

The candlestick chart presents the same data as the bar chart but in a more visually accessible form. Each “candle” consists of a “body,” which shows the difference between the opening and closing price, and “wicks” or “shadows,” which indicate the high and low values during the period. The color of the candles (typically green for gains and red for losses) allows for a quick interpretation of data. Candlestick charts are highly valued by traders for the richness of information they provide, allowing for the identification of specific price patterns that may signal potential trend changes.

Practical Use of Charts

Choosing the right type of chart depends on the trading style, investment preferences, and which information is most important to the investor. Here are some tips for effectively using each chart type:

-

Long-term investors may prefer line charts due to their simplicity and ability to display general trends.

-

Medium-term traders may find bar charts more useful as they provide detailed insights into price fluctuations within a given period.

-

Short-term speculators often rely on candlestick charts, which enable deep market analysis and the identification of specific price patterns.

Keep in mind that regardless of the chart type you choose, the key to success lies in consistency in analysis and combining various technical analysis methods—including indicators and price patterns—to get the fullest possible picture of the market.

In the next lessons of the course, we will dive deeper into how to read and interpret each type of chart, as well as learn how to identify key price patterns and their potential implications for price movements.