In today’s lesson, we will take a closer look at technical analysis, a tool used by both investors and speculators to make investment decisions. Our goal is to understand what technical analysis really means, what its advantages and limitations are, and how the approaches of investors and speculators differ.

Investors vs. Speculators

Technical analysis is used by both investors and speculators, although their goals and time horizons differ significantly. Speculators typically focus on short-term price movements and often use technical analysis to react quickly to market changes. Investors, on the other hand, may use technical analysis to identify long-term trends and better time their buy or sell decisions, while also considering dividends or coupon payments.

It’s important to remember that there’s no clear line between a speculator and an investor—each may use technical analysis in line with their investment strategy.

Risk Management

One of the key aspects of using technical analysis effectively is risk management. Contrary to popular belief, short-term trading—such as hourly trading—can be less risky than holding securities long-term without a clear exit plan. Technical analysis allows for precise entry and exit points, which significantly reduces the risk of losses.

Anyone involved in technical analysis knows that the key element is not only identifying potential profits but above all controlling potential losses. In this way, technical trading becomes a discipline focused on minimizing risk.

Basics of Technical Analysis

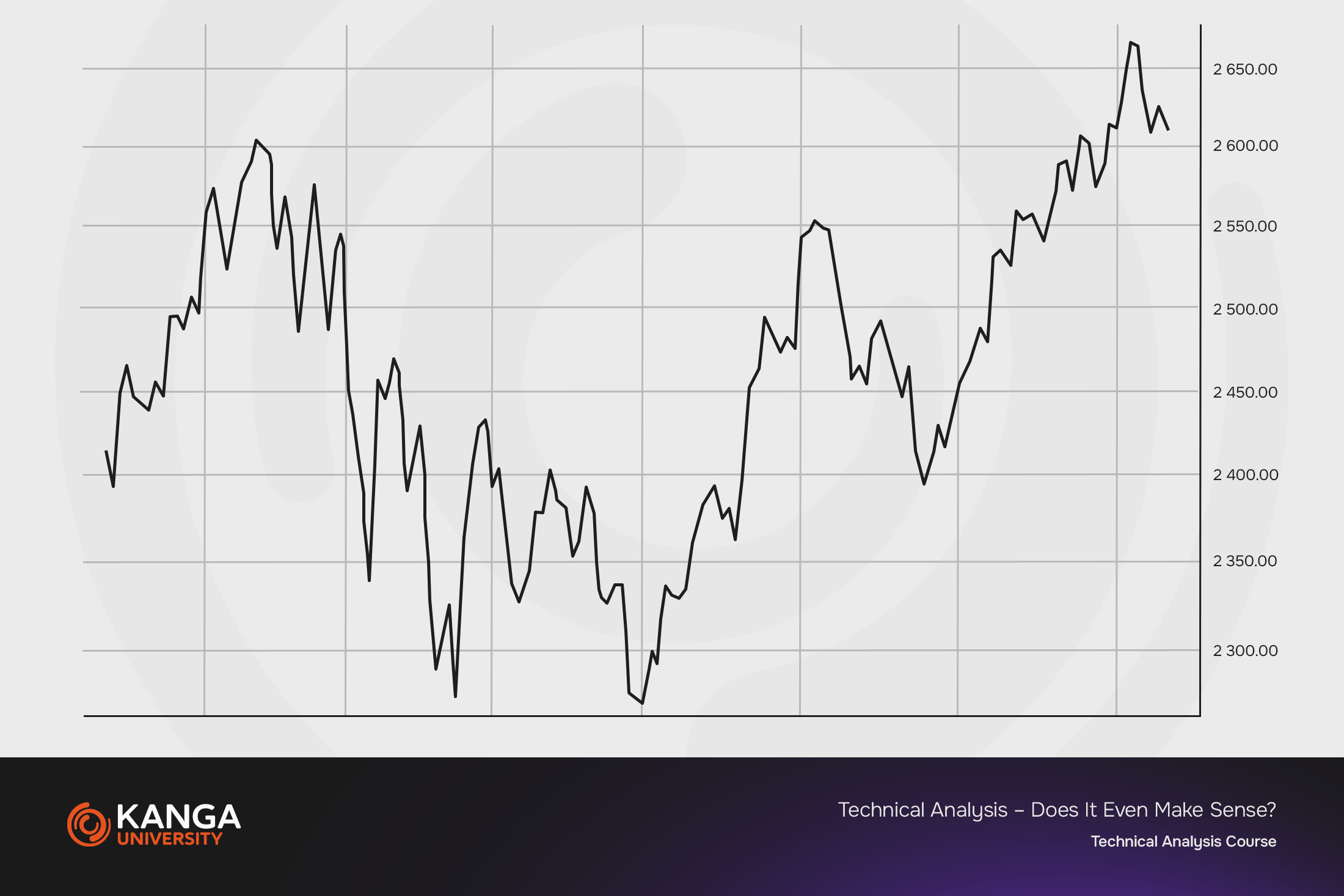

Technical analysis is based on the assumption that all information—both current and future—is already reflected in a stock’s price. Therefore, technical analysts focus on price charts, trends, and technical indicators to forecast future price movements.

The three main principles of technical analysis are:

-

Stock prices are driven by supply and demand.

-

Stock prices move in trends.

-

History tends to repeat itself.

By using these principles, analysts can identify price patterns and technical indicators that suggest potential price directions. Although technical analysis offers powerful tools for market forecasting, it’s essential to remember that no method guarantees 100% accuracy. That’s why risk management and establishing clear rules of conduct are crucial for anyone using technical analysis in their investment strategy.

In summary, technical analysis can be extremely useful for both investors and speculators. Whether you’re a long-term investor or a short-term trader, it is essential to understand that effective use of technical analysis requires discipline, continuous learning, and conscious risk management.