Crypto traders and investors have different strategies to make money at the moment. They can decide to spot trade, stake, or mine crypto. Still, crypto futures have become a common strategy among many people because of how unique it is.

Although considered complex, futures contracts are simple to learn. Imagine crypto futures as a market where you enter into an agreement with a seller regarding the price you will pay for each product. The same applies to selling. In this lesson, we will break down what crypto futures are, how they work, and why traders use them.

What Are Futures Contracts?

Assume you are someone who loves playing PS5 games, and you hear that GTA VI will be released in 4 months. Currently, stores are taking pre-orders for $65, but you believe the price could increase to $110 due to hype.

So, you meet a seller and sign an agreement that says:

“I will buy GTA VI from you for $65 in 4 months, no matter what the price is then.”

If GTA VI launches and the price rises to $110 after 4 months, you can still buy at $65 because of your agreement and save $45. Assuming the price is $55, you still pay the $65 agreed price and lose $10.

That’s the same way crypto futures contracts work.

They are legal agreements to buy or sell a coin at a predetermined price on a specific date in the future. These contracts are standardized and traded on crypto exchanges, although they originated in traditional markets.

Furthermore, they allow you to trade Bitcoin and other cryptocurrencies without owning them. You are not buying the coin itself, but buying a contract that mirrors its value. Subsequently, you can place bets on where the price of a coin can go in the future. If you expect the price to increase, you go long, and if you expect it to fall, you go short.

Each contract includes details such as the expiration date, contract size, and settlement method. The settlement method is either in cash or through the underlying crypto. Additionally, there are also perpetual contracts, which don’t expire and are common in the crypto market.

Understanding Crypto Futures

Crypto futures are based on the value of tokens like BTC, BNB, or meme coins like DOGE. The primary benefit is that these contracts enable investors to bet on price movements without transferring tokens on-chain. In other words, you don’t have Dogecoin or SHIB in your wallet when you are trading their futures contracts.

Imagine this:

- Let’s assume you believe DOGE will be worth more than $1 by the end of 2025. So, instead of buying DOGE at an exchange and waiting for the price to increase, you can just enter a futures contract.

- If your prediction is correct, you profit from the price increase without having DOGE in your wallet.

- At the same time, if you expect prices to decline, you can short a futures contract and potentially profit from the decrease.

Spot Trading vs Futures Trading

To understand why futures matter, it helps to compare them with spot trading.

- In spot trading, you buy the actual crypto. If you want to invest in Dogwifhat, you buy WIF. The same with any other token. You own the coin and store it in your wallet or on an exchange.

- For spot trading, the only way you make money is if the price of WIF increases. The same applies to another crypto. So, the risk is that if the price declines, you won’t make any profit. In other words, spot trades are settled instantly and are easy to understand.

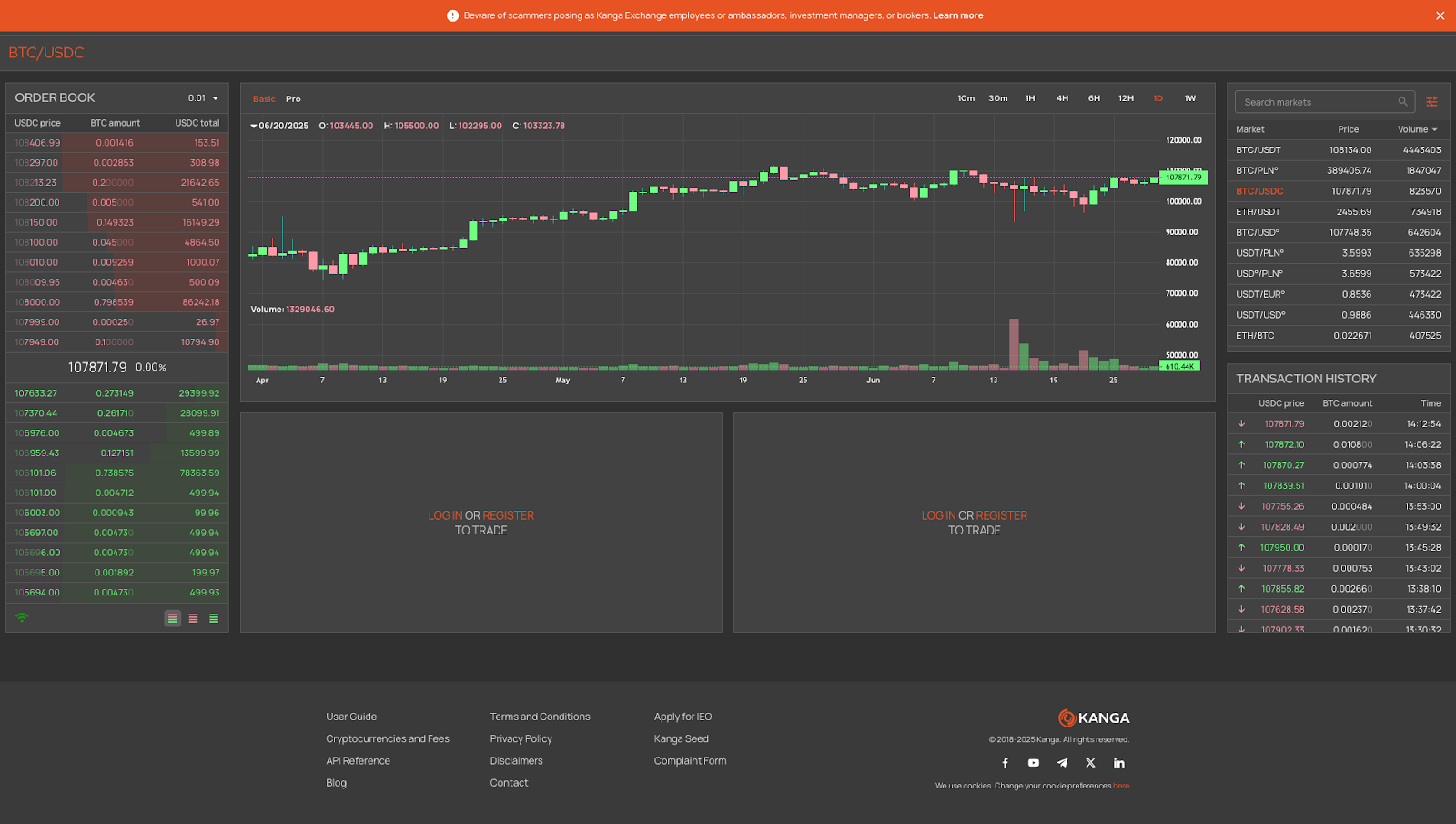

Example of a spot trading interface on Kanga Exchange

For futures trading, it is more complicated.

- Instead of having the coin in your wallet, you trade contracts that follow its price. Hence, the main advantage is that you can make a profit whether the price goes up or down. All you need to do is make the right bet on a cryptocurrency’s price movement, and you will make a profit.

- If you are trading futures, you learn about a term called leverage. For those who trade spot, they can only buy what they can afford. On the other hand, futures traders can borrow capital to open larger positions. The flexibility of futures provides higher leverage, hedging capabilities, and strategic positioning. However, the problem for beginners is that it is more complicated.

What Is Leverage, and How Does It Work?

You can do futures trading without coming across the word leverage. For a better understanding, it is the secret weapon or hidden trap in futures trading. How?

Indeed, this feature allows you to open positions higher than the money you currently have by borrowing funds from the exchange.

For example, if you have $250 and use 10x leverage, you can increase your position to $2,500. Let’s say you are trading PNUT futures contracts. Assuming the market increases by 20% with your 10x leverage, you get a $500 profit.

Now, imagine what would happen if the market dips by 20% in the same position. What happens? Your entire capital would be wiped out, and you would be liquidated by the exchange on which you are trading.

Leverage is expressed in multiples, such as 2x, 5x, 10x, or even 100x, on some exchanges. However, with high leverage comes high risk, as we have already explained above. Even a small market move can cause liquidation to prevent more losses.

What Is Liquidation?

The bright side of futures trading is that you make a massive amount of money. However, the dark side is liquidation. It is very painful to experience and happens when your margin balance drops below the minimum required to keep your position open. The exchange where you are trading will be forced to close your trade.

For instance, if you are trading ADA and open a 25x leverage position with $400 of your own money. If ADA’s price declines by 25%, your position will be closed and liquidated by the exchange. You won’t make any profit from this trade, and you will also lose your capital in the process.

Nevertheless, some exchanges may notify you to add funds before liquidation happens. Others will liquidate automatically when the minimum requirements are breached. Either way, liquidation usually comes with a fee and a heavy emotional toll.

To reduce your chances of being liquidated, consider the following steps.

- Use less leverage.

- Set stop-loss orders.

- Monitor your trades actively.

- Maintain a healthy margin buffer.

Why Use Futures at All?

If futures come with higher complexity and risk, why bother?

The answer is because of two main use cases: hedging and speculation.

Hedging is about protection. Assuming you have a business that accepts crypto payments. You hold large amounts of Ethereum, but you are concerned about market crashes due to war and economic tensions.

Instead of converting it all to fiat, you could short ETH futures to lock in current prices. If the market crashes, the value of your ETH decreases, but you won’t be affected because of the gains in your short position. That’s hedging in action.

Speculation, on the other hand, is about opportunity. You may have a strong belief that PNUT will rise or that a correction is coming. By going long or short on futures, you can increase your potential profit through leverage. Apparently, speculators aim to time the market and capitalize on volatility. Their primary goal is to generate returns beyond what is possible with spot trades.

Summary

- A futures contract is a legal agreement to purchase or sell a crypto asset at a set price after a specific period. It can be one month or 3 months.

- Unlike spot trading, futures allow you to profit from both rising and falling prices.

- Leverage lets you control bigger positions, but there’s a massive risk of liquidation.

- Futures can be used for speculation or hedging, depending on what you want to do.

This lesson just covered what a futures contract is, how it differs from spot trading, and how leverage can increase your gains or losses. Additionally, it explained how liquidation works and why traders choose to use these tools for hedging or speculation.